Position:Home > News > Industry Report > Presidential election, direction of change in Indonesias nickel industry chain determined

Position:Home > News > Industry Report > Presidential election, direction of change in Indonesias nickel industry chain determined

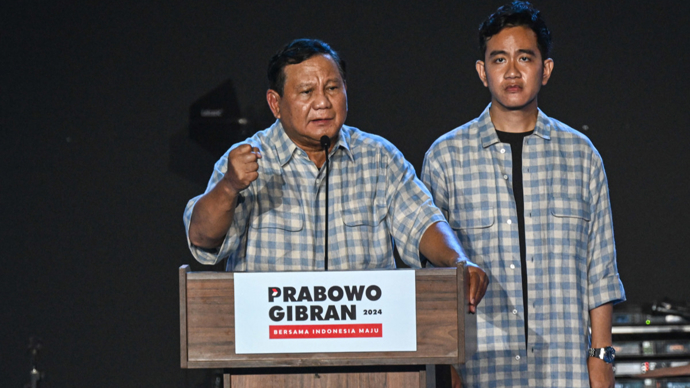

On October 20th, Indonesian President elect Prabowo will hold his inauguration ceremony at the Parliament Building in Jakarta, officially beginning his 5-year term. Prabowo will vigorously develop agricultural modernization, achieve food self-sufficiency, ensure national food security, and provide strong material support for the project. Continuing and expanding downstream mineral policies will be another key focus of the Prabowo governments governance. Indonesia is a key mineral rich country. During the Joko era, the implementation of downstream policies for nickel mines significantly increased the added value of minerals, causing the export value of nickel to soar from about 2 billion US dollars to about 33.8 billion US dollars. Prabowo plans to expand downstream policies to key minerals such as bauxite, tin, and copper, further improve the business environment, attract foreign investment to build factories, promote the construction of a complete electric vehicle production and supply chain system in Indonesia, and build Indonesia into a regional and even global electric vehicle production center. Can this politician, who played the pro people card with the image of a "cute dance grandpa" during the election, be skilled in governing the country? How will he, who claims to be the successor of Joko Widodo, continue the Joko Line and move towards realizing the vision of a "golden Indonesia in 2045"? The world will wait and see. The Indonesian media newspaper (author Fajar Hirawan, lecturer at the School of Economics and Business at the International Islamic University of Indonesia) believes that: The trade relationship between China and Indonesia is not without challenges. In 2018, Indonesia had a huge trade deficit with China. Since 2020, CEIC data shows that Indonesia has once again had a trade surplus with China. However, the dominant position of Chinese products with high added value still poses a threat to the competitiveness of Indonesian products. In order to enhance the competitiveness of Indonesian products in the Chinese market, several strategic steps need to be implemented. Firstly, increase the added value of exported products; Secondly, strengthen technological collaboration and innovation; Thirdly, diversification of trading partners; Fourth, increase the use of trade agreements Therefore, according to Mysteels report, the following information is reasonable. 1、 The approval progress of nickel ore continues to be approved At present, there are still over a hundred Indonesian nickel mines that have not been approved. Although the approval process is relatively slow, new approved nickel mines are flowing out one after another every week. Some mines on Little K Island, where quota approval was previously restricted, have finally completed the procedures this week. However, the approval status of nickel mines in the next two years still raises concerns: as of now, the approved amount of RKAB for Indonesian nickel mines in the 25th year is about 250 million wet tons, and the approved amount of RKAB for Indonesian nickel mines in the 26th year is about 230 million wet tons. 2、 Indonesia nickel iron project equity quietly changes With the development of the nickel industry and the increasing investment of Chinese enterprises in Indonesia, Indonesia has begun to lay out its policy restrictions on nickel resources in recent years to ensure its control: the Simbara system has been launched, and the approval of excess nickel iron production capacity has been prohibited. Now, the plan for taxing nickel iron exports/canceling corporate income tax exemptions has also been put on the agenda. In this context, the equity of the Indonesian nickel iron project has quietly changed, and some existing shareholders of Chinese funded projects have begun to reduce their holdings or directly sell the pyrometallurgical production lines in the park, increasing their holdings of Indonesian capital or overseas capital other than China. 3、 Indonesia attracts more overseas capital Indonesia is no longer satisfied with being a producer of nickel. This year, Indonesia has continuously released signals hoping to attract foreign investment in downstream nickel enterprises and promote the development of local nickel resources towards stainless steel and new energy industries. In August 2024, the 1.2 million ton stainless steel smelting project of Honor Metal, a joint venture between Indias Jindalai and Qingshan Industrial, officially started construction in IMIP Park, Indonesia. In addition, the Indonesian APNI Association stated that Indonesia is expected to build its nickel industry through environmental and social governance (ESG) concepts, attracting more foreign investment. Capital from not only China, but also Japan, the European Union, South Korea, Australia and other countries will enter Indonesia to jointly layout and construct the downstream nickel industry.

Copyright 2021 Zhejiang Benji Stainless Steel Co., Ltd All Ringhts Reserved