Position:Home > News > Industry Report > The rise of Indonesian stainless steel industry changes the global supply pattern

Position:Home > News > Industry Report > The rise of Indonesian stainless steel industry changes the global supply patternFrom the change of global stainless steel production, before 2007, the global stainless steel industry experienced a rapid development stage. From 2007 to 2009, affected by the global financial crisis, the demand for stainless steel fell sharply, the industry had relative overcapacity, and the output increased negatively. From 2010 to 2016, global crude steel production resumed rapid growth, and China played a leading role. Among them, in 2014, Chinas stainless steel output accounted for more than 50% of the world for the first time, and rkef (rotary kiln submerged arc furnace) ferronickel smelting and steelmaking integrated technology reduced the global stainless steel production cost and led the technological revolution of the stainless steel industry. In 2016, with the implementation of the supply side structural reform of Chinas iron and steel industry, excess, illegal and backward production capacity was gradually eliminated. In the following years, the growth rate of Chinas stainless steel production slowed down. One belt, one road initiative, Chinas stainless steel enterprises began to plan the NNI iron project in Indonesia to plan for the construction of the stainless steel industry chain. According to the forecast data of the annual meeting of the international stainless steel Forum (ISSF), with Chinese enterprises establishing huge production capacity in Indonesia, Indonesia will overtake India to become the second largest stainless steel producer in the world in 2021.

The picture shows the global stainless steel production

From the perspective of regional distribution, the increase of global stainless steel production in recent years mainly comes from China and Indonesia, and the production in Europe and the United States is relatively stable. Among Asian countries, Japan and South Korea have limited output growth. In the distribution of global stainless steel production, the global stainless steel production of Asia, the European Union and the United States accounted for 53%, 33% and 9% respectively in 2006, and 81%, 13% and 4% respectively in 2020. The output of stainless steel in Asia increased rapidly. Among Asian countries, the output in 2006 mainly came from China, Japan and India, accounting for 18%, 14% and 7% of the output of stainless steel in Asia respectively; In 2016, the proportion of Chinas output increased significantly to 59%, and that of India and Japan decreased to 5%. However, Indonesias stainless steel output attracted global attention with a share of 5%.

In terms of per capita stainless steel consumption, in 2020, Chinas per capita stainless steel consumption was 18 kg, far exceeding the per capita stainless steel consumption of 2.5 kg in India and Brazil, but there was still a gap compared with the per capita stainless steel consumption of 25-40 kg in South Korea, Italy and other countries. Although Chinas per capita stainless steel consumption has been at a high level, the proportion of stainless steel consumption in steel consumption is relatively low, and there is still room for growth in Chinas stainless steel consumption. In 2020, the per capita consumption of stainless steel in Indonesia was about 2kg, far behind other countries, with great growth potential in the future. On the whole, the performance advantages and per capita steel consumption of stainless steel support the development prospect of stainless steel, while the supply of raw materials, the growth rate of demand and industrial profits will determine the progress of new stainless steel production capacity.

Indonesia strengthens nickel mine management

Indonesia is located in the tropics of Southeast Asia, across the equator and has a special island tropical climate. Its nickel ore reserves are about 21 million tons, accounting for about 24% of the world, ranking first in the world. In recent years, Indonesia is also actively developing mineral resources, and the output of nickel ore ranks first in the world, accounting for about 34%. Indonesias resource endowment provides many conveniences for nickel ore development: more than 90% of laterite nickel ore is concentrated on Sulawesi island (big K Island) and Maluku Islands (small K Island) in the middle and nearby islands, and Kalimantan island and Sumatra island have a large number of coal and oil and gas resources, which provide low-cost raw materials and energy for stainless steel production in Indonesia. Due to the low price of raw materials, the current cost of Indonesian nickel pig iron is 700 yuan / nickel ton, and the hot rolling cost of 304 stainless steel is 12000 yuan / ton; The production cost of nickel pig iron in China is 1200-1500 yuan / nickel ton, and the production cost of stainless steel calculated at the current price of nickel iron is roughly more than 18000 yuan / ton. Therefore, relying on the advantage of integrated red delivery of raw materials, the lowest cost point of global stainless steel production is transferred from China to Indonesia.

In the development plan of the Indonesian government for 2020-2024, its five-year average GNI growth target is 5.7%, and the industrial structure transformation is realized, that is, from the original raw material export country to the modern manufacturing country. At the same time, the plan proposes to accelerate the promotion of six pillar industries to promote the industrialization process, including the metal smelting industry. The Indonesian government plans to support the construction of industrial parks to develop middle and downstream industries, extend the industrial chain and improve the added value of industrial products. Therefore, Indonesia will ban the export of raw nickel ore completely from 2020, and increase tax preference for enterprises investing in projects in Indonesia, so as to make the domestic price of nickel ore low and promote the development of smelting industry. According to the data, the output of nickel pig iron in Indonesia was 900000 tons of nickel in 2021. It is most optimistic that the new nickel pig iron production capacity will reach 810000 tons of nickel in 2022, which will provide full support for the rise of the local stainless steel industry.

According to the speculation of the Chinese Chamber of Commerce in Indonesia, Indonesia will also strengthen the smuggling management of nickel ore and strictly restrict the export of raw ore in the future; It is planned to impose an export tariff of 2% on nickel pig iron and ferronickel, and implement progressive collection according to the market; Limit the construction of low-grade smelting and processing plants and no longer approve the construction of pyrometallurgical smelters; Strictly rectify the mining rights, and plan to combine the exploration certificate and mining certificate into one, and extend the shareholding proportion and years of foreign mining rights.

Stainless steel production capacity ushers in a period of rapid development

Under the background of Indonesias ban on mining, more than 90% of Chinas nickel ore depends on imports from the Philippines. Therefore, steel enterprises are looking for a way out and layout the "ferronickel stainless steel" industrial chain in Indonesia. Chinas one belt, one road, Indonesias strategic east wind and Indonesia mountain industry are widely distributed in the Indonesia nickel industry. Delong nickel, Jinchuan group, Xinxing cast and Li Qin have invested in the construction of stainless steel nickel and iron projects in Indonesia, and gradually formed industrial clusters. Indonesias stainless steel production capacity is developing rapidly.

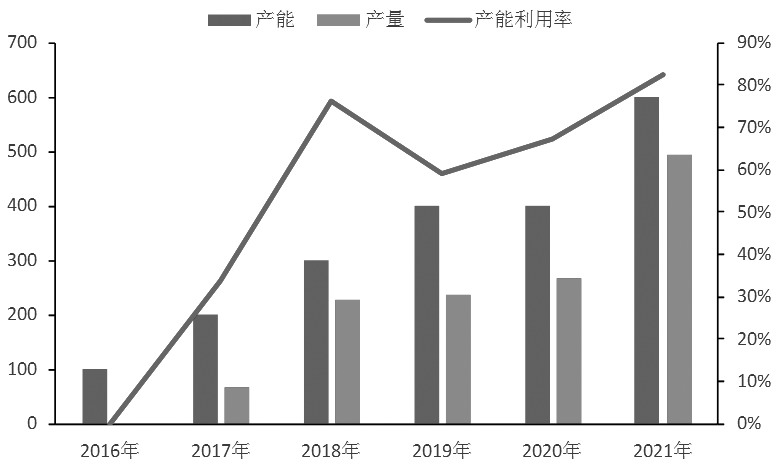

The picture shows the output of stainless steel in Indonesia (Qingshan + Delong)

In 2016, 1 million tons of stainless steel crude steel production capacity was built in Qingshan, Indonesia. Since then, the production capacity has been increasing. It is estimated that the production capacity of stainless steel crude steel in Indonesia will reach 6.5 million tons in 2021. According to the data, Indonesias stainless steel production will be close to 5 million tons in 2021. It is expected that the output growth rate will exceed 30% in 2022, overtaking India to become the second largest stainless steel producer in the world. Liqin plans to build a 3 million ton stainless steel project in Indonesia. At present, the hydrometallurgy project has been successfully put into operation in May 2021 and the pyrometallurgy project has been put into operation in January 2022. In addition, considering the potential new stainless steel production capacity brought by the industrial chain extension of a number of ferronickel production enterprises such as Xinxing cast pipe, Jinchuan, Yilian, Xinhualian and Zhenshi Oriental, Indonesia, Indonesia will become a new growth point of global stainless steel production in the future.

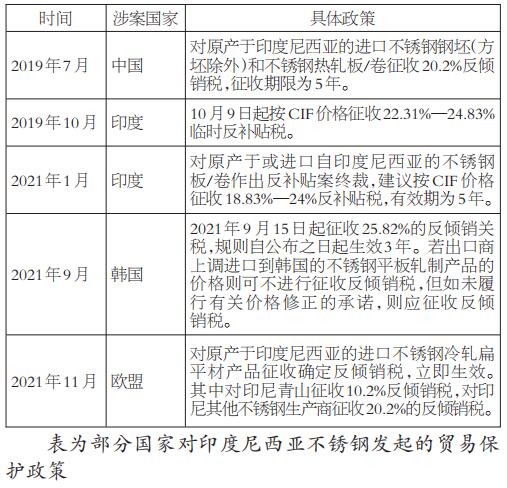

The international trade barrier of stainless steel has increased

At present, Indonesias stainless steel production capacity is almost 25 times that of the countrys demand. Most of these stainless steel products will be exported to the international market, reducing the local stainless steel or export price advantage of other countries, which will have a great impact on the 300 series stainless steel market of other countries. In this case, countries have launched trade barriers against Indonesian stainless steel; One is tariff barrier, that is to reduce the import enthusiasm of foreign goods by levying high tariffs; The other is non-tariff barriers, that is, measures such as import license and import quota system are taken to restrict the free import and export of foreign goods.

In the future, with the expansion of stainless steel demand in emerging economies such as ASEAN and India, these countries and regions will become an important direction for Indonesias stainless steel export, while the impact on other countries and regions will be reduced accordingly. However, fundamentally speaking, only by improving smelting technology to reduce costs and accelerate the optimization and upgrading of product structure can we truly face the impact of low-cost stainless steel in Indonesia and realize the high-quality development of our own industry.

Copyright 2021 Zhejiang Benji Stainless Steel Co., Ltd All Ringhts Reserved